In the age of digital transactions, managing funds and performing financial operations from mobile devices has become increasingly popular. Today, it is possible to securely store and transfer virtual currencies, all within an easily accessible interface. Many users are turning to innovative solutions that allow them to interact with their digital assets through familiar communication channels, making transactions seamless and efficient.

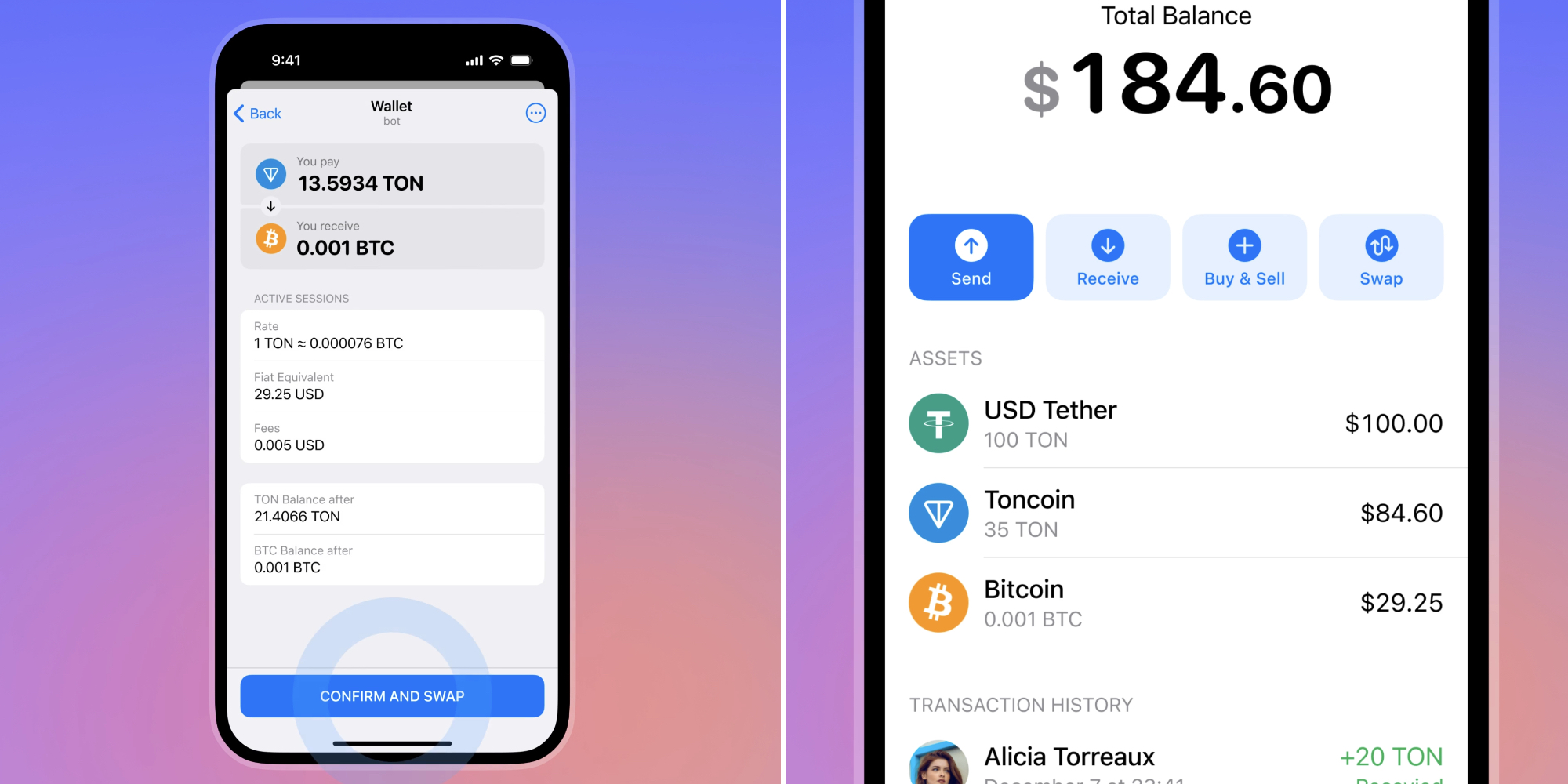

By integrating financial services into messaging applications, individuals can access their funds and execute operations without the need for complex setups or additional software. This approach enhances convenience while keeping everything within one platform. Users are offered an intuitive way to manage their resources, whether for personal use or business purposes, without stepping away from their daily communication tools tg wallet.

However, while these technologies offer incredible convenience, they also introduce new challenges. The increasing popularity of such services makes them prime targets for cybercriminals. To mitigate these risks, it is essential to implement robust security measures that protect both users' private data and their digital assets from unauthorized access and theft. Understanding the best practices for safeguarding sensitive information is crucial for anyone looking to take advantage of these innovative financial solutions.

Managing Digital Assets via Messaging Platforms

In recent years, the intersection of messaging services and digital finance has led to the development of intuitive solutions that allow users to interact with their financial resources directly from communication tools. This trend has made it easier for individuals to access, send, and receive digital currencies or other assets without leaving their preferred messaging platforms. The ability to manage such resources through chat applications offers a high level of convenience, allowing for seamless transactions and real-time updates, all within the environment users are already familiar with.

Innovative integrations have transformed messaging applications into versatile hubs for managing various forms of digital wealth. By leveraging simple commands, users can monitor their balances, execute transfers, and even engage in trading activities, without needing to navigate through complex external interfaces. This innovation eliminates many of the traditional barriers to digital asset management, such as the need for specialized software or deep technical knowledge.

These platforms also provide a high degree of flexibility and security. Through the use of advanced encryption and authentication protocols, users can rest assured that their financial information remains protected while using these services. Furthermore, the use of decentralized technologies ensures that control over the assets remains in the hands of the user, making transactions more transparent and reducing the risks associated with third-party intermediaries.

Real-time accessibility is another key advantage. Whether on the go or at home, individuals can manage their holdings with just a few taps or keystrokes, receiving notifications and updates as needed. This instant access to digital assets offers users greater control and the ability to make informed decisions promptly, improving overall efficiency in managing personal finances.

Enhancing Security in Virtual Financial Systems

As digital currencies and online financial services continue to grow, ensuring the security of these platforms has become increasingly vital. The decentralized nature of many virtual financial systems presents unique challenges, making it essential to implement robust protection mechanisms. Users must be able to trust that their assets are safe from hacking attempts, fraud, and other forms of cyber threats, while still maintaining an easy and seamless experience.

Advanced encryption techniques have become a cornerstone in safeguarding digital transactions and account information. By encrypting data both during transmission and while stored, these methods ensure that sensitive information remains inaccessible to unauthorized parties. Additionally, multi-layered authentication processes, such as two-factor authentication (2FA), significantly reduce the risk of unauthorized access by requiring multiple verifications before granting access to user accounts.

The integration of blockchain technology further enhances security by offering a transparent, immutable ledger of transactions. Each transaction is verified by a distributed network of nodes, making it nearly impossible to alter or manipulate transaction records. This decentralized approach minimizes the reliance on centralized entities, reducing the risk of single points of failure that could compromise security.

Furthermore, ongoing monitoring and real-time alerts provide users with immediate notifications of suspicious activities, allowing them to take action quickly if something seems amiss. Automated systems can detect irregular patterns and flag potentially fraudulent transactions, helping to mitigate risks before they escalate into serious threats.

|